Risk Management

| << Back | Download |

Misdiagnosis of a Nevus by an Optometrist Insured with Another Carrier

By Ryan Bucsi, OMIC Senior Litigation Analyst

Digest, Summer 2010

ALLEGATION: Failure to diagnose choroidal melanoma resulting in patient’s death.

DISPOSITION: The case settled for $1.5 million with an arbitrator apportioning $500,000 of the settlement to an OMIC insured group.

Case Summary

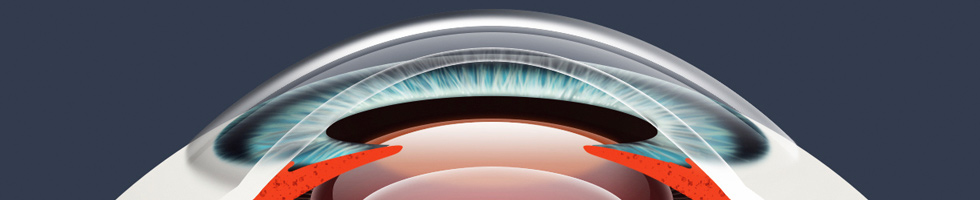

A patient presented to an OMIC insured ophthalmology group for a routine eye examination. The patient was examined by an optometrist who was employed by the group but who maintained separate professional liability insurance with another carrier. During the examination, the optometrist identified a nevus on the patient’s right eye. A diagram of the nevus was drawn in the patient’s chart, and the optometrist instructed the patient to return in one year. The patient returned on an emergency basis about 11 months after the initial exam, complaining of an inability to see out of a portion of the right eye. During this visit, an ophthalmologist examined the patient, diagnosed a choroidal melanoma, and immediately referred the patient to a retinal specialist for a same-day consult. The retinal specialist confirmed the diagnosis and sent the patient to a local specialist for treatment. The melanoma measured 16 x 17 mm with a height of 7 mm. Despite treatment for the melanoma, the patient died approximately three and a half years following the initial examination by the optometrist.

Analysis

The optometrist testified during deposition that although the nevus was not suspicious, she had ordered a fundus photograph. The medical record contained neither a fundus photograph nor a record of a bill for a fundus photograph. Plaintiff experts opined that the optometrist failed to diagnose a suspicious nevus, failed to take a fundus photograph, and failed to advise the patient to return in three months. Plaintiff experts also opined that the group was negligent for failing to properly train and supervise the optometrist. Furthermore, plaintiff experts felt the group fell below the standard of care by not notifying the patient that she was being treated by an optometrist and not an ophthalmologist. There was no formal training program or written protocols at the OMIC insured group office. Physicians there stated that they were comfortable with the competence of the optometrist based on her five years of experience. The defense had trouble finding experts to support the care rendered by the optometrist and the group. In addition, the defendants could not establish a causation argument. Melanoma experts opined that the size of the tumor at the time of diagnosis indicated that it was likely present but missed on the initial exam by the optometrist. Without a fundus photograph, the defense could not argue to the contrary. A settlement of $1.5 million was reached, but OMIC and the other carrier could not agree on how the liability should be apportioned. A binding arbitration was scheduled; the only agreement going into arbitration was that neither carrier would be required to pay over its $1 million policy limit. The arbitrator ruled that the optometrist was 70% liable and OMIC’s insured group was 30% liable. Since 70% of $1.5 million exceeded the co- defendant’s policy limits, the other carrier paid $1 million and OMIC paid the remaining $500,000.

Risk Management Principles

Optometrists and ophthalmologists have different scopes of practice and competencies. While some eye conditions can be managed independently by optometrists, others require consultation with, or management by, an ophthalmologist. Eye conditions that can lead to severe vision loss, systemic disease, or death are best managed in consultation with an ophthalmologist. In this case, the role of the employed optometrist was not well defined by the OMIC insured group and there was no formal training, ongoing evaluation of her competency, or written protocols. The optometrist felt the nevus was non-suspicious so she did not consult with the ophthalmologist during her one and only examination of the patient. As this case demonstrates, communication between a group’s optometrists and ophthalmologists is, at times, critical in order to achieve optimal patient care. Risk management experts at OMIC recommend that the optometrist’s role be defined in writing in terms of what conditions he or she can manage independently, what conditions require consultation with an ophthalmologist, and what conditions require management by an ophthalmologist (see this issue’s Hotline column and “Coordinating Care with Optometrists,” available at www.omic.com, for a more detailed discussion and sample protocol).

Please refer to OMIC's Copyright and Disclaimer regarding the contents on this website